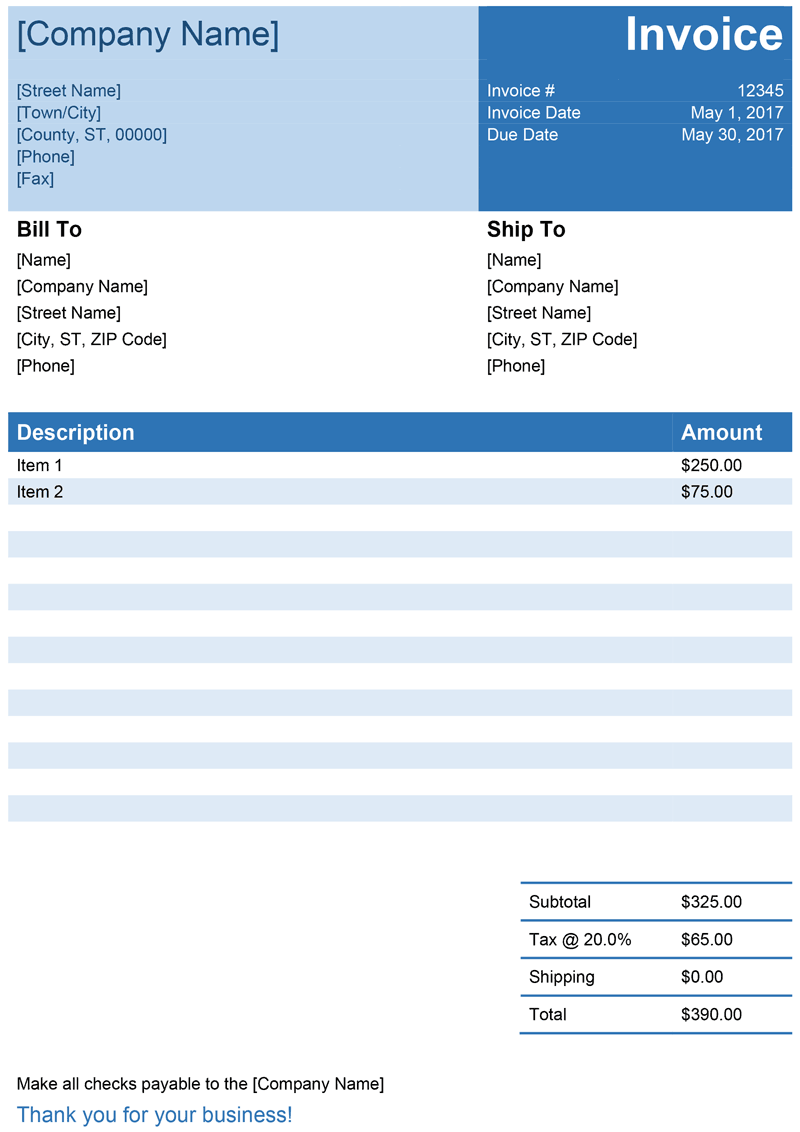

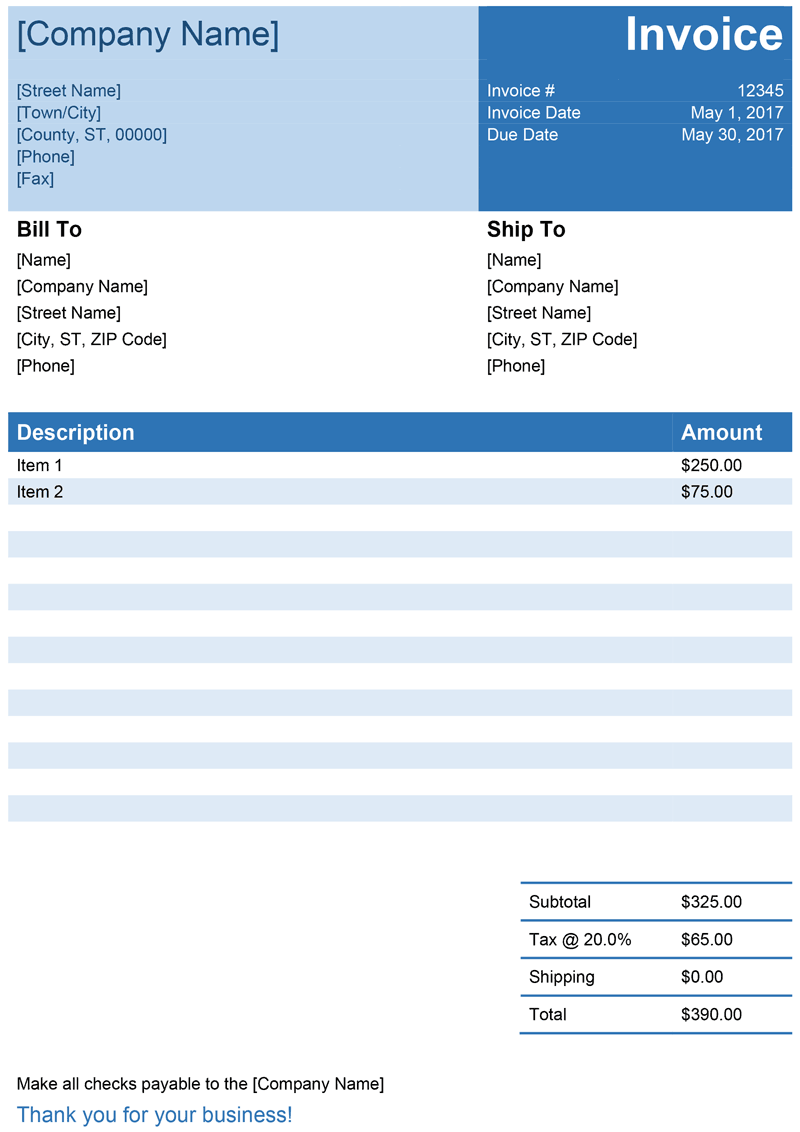

Quantity of Goods/Services: The quantity of the products or services sold. Description of Goods/Services: A brief description of the products or services sold. Buyer’s Information: Name, address, and contact details of the buyer. Seller’s Information: Name, address, and contact details of the seller. Invoice Number: A unique identifier for the invoice. Date of Invoice: The date the invoice is issued. In this section, we’ll outline the 15 key elements that should be included in a tax invoice to ensure it meets legal and regulatory requirements. Having a clear and accurate tax invoice is essential for businesses and service providers for accounting and record-keeping purposes. Don’t Miss a Beat: 15 Vital Elements to Include in Your Tax Invoice Whenever a sale is made the necessary additions are done to the sales invoice template. Every organization has its own invoice template. Hence it can be stated that an invoice is a small statement of goods and services that is provided by a business to another entity. Total amount received from the customer and the amount owed to the customer. Any other terms and conditions of the transaction like mode of payment, advance payment, etc. Any rebates or discounts offered to the customer. The respective quantities of the purchase.  Names of the products and services sold to the customer. Some common elements added to an invoice include the following: This document helps convey the written details of the products or services being bought. It is utilized by an organization to make communication with the customer who is making a purchase or getting services.

Names of the products and services sold to the customer. Some common elements added to an invoice include the following: This document helps convey the written details of the products or services being bought. It is utilized by an organization to make communication with the customer who is making a purchase or getting services.

One very important document that is used while making selling and buying transactions is called the sales invoice.Īn invoice is not just a document of sales but it is essentially an accounting tool. Manufacturers and service providers may also buy and sell supplies to other stakeholders in the industry. These transactions may not only be specified to retailing companies. If you are part of a business entity you must know that there are always some kind of buying and selling taking place in organizations. There are several important documents that are used for business purposes on a daily basis. There are 44 of them, in Microsoft Word, Excel, and PDF formats. To make things easier for you, we’ve got a bunch of tax invoice templates for you to download for free. It includes important details like the products or services sold, their prices, and any discounts offered. That’s why you need a tax invoice – it’s an official accounting tool that helps you keep track of your sales.

If you’re a business owner or service provider, you know how important it is to keep track of your finances. 44 Free Tax and Non-Tax Invoice Templates: Perfect for Small Business Owners and Service Providers

0 kommentar(er)

0 kommentar(er)